Valuing historic buildings

|

There are no real hard and fast rules for valuing historic buildings and established valuation principles used for more modern buildings may not apply.

Valuations will be affected by styles, locations, condition, local and national policies, whether the building is listed or in a conservation area, the availability of grant aid, public perception and so on. In addition, it is difficult for valuers to be objective as considerations such as the nature of the surrounding area, convenience of access, and views of and from the property can be subjective.

Most valuers’ work is based on the concept of ‘market value’, which is the value the building might be reasonably expected to achieve after reasonable exposure in a free, stable market assuming that both buyer and seller are acting on their own free will and have a reasonable period in which to negotiate the sale. Real market value is not the same as the value to the owner, who may be affected by feelings of sentimentality and a distorted sense of worth. Also, value and price are not the same: even though prices are often the best indicators of market value, they are not decisive.

For more information see: Market value.

However, historic buildings can be unique or very close to it. This means that using market prices to value them is a difficult task. Furthermore, the legal restraints associated with any building works and the obligations to repair (e.g Grade 1-listed status) make valuing problematic.

Steps that may help establish the value of a historic building:

- Inspection, involving a detailed survey and analysis;

- Undertaking a historic survey involving any statutory listing, researching the building’s history and identifying any reference works, local records etc;

- Undertaking a detailed condition survey;

- Understanding the architectural qualities and any special features, their local significance and contribution to the visual environment or townscape;

- Understanding who is likely to be interested in buying the building, whether private individuals, companies, developers, local authorities, social groups etc;

- Understand and accounting for prevailing market conditions;

- Considering how much it could cost to repair or adapt and maintain the building for whatever use is envisaged.

- Understanding constraints on development. for example, listed buildings involve a government-imposed control on owners that could make repairs and refurbishments far more costly than might at first be appreciated;

- Considering whether the building has heritage value – can it be said to be a national treasure in any way?

- Considering how easy it might be to get grant aid.

- Assessing whether the building has any capacity to provide future income.

These considerations may help establish a historic building’s value, which in turn may help potential buyers (or sellers) make an informed decision.

[edit] Related articles on Designing Buildings Wiki

- Appeals against urgent works notices.

- Building Preservation Notice.

- Certificate of immunity.

- Compulsory purchase orders for listed buildings.

- Conservation area.

- Conservation officer.

- Ecclesiastical exemption.

- Enterprise and Regulatory Reform Act 2013 and listed buildings.

- Heritage partnership agreement.

- Historic England.

- Institute of Historic Building Conservation.

- Listed Building Heritage Partnership Agreements.

- Local Listed Building Consent Orders.

- Listed Building Consent Order.

- Manor Farmhouse listed building prosecution.

- Planning permission.

- Scheduled monuments.

- Society for the Protection of Ancient Buildings.

- Tree preservation order.

- Urgent works in advance of a listed building consent.

- Use of injunctions in heritage cases in England and Wales.

- Use of direct action in heritage enforcement cases in England.

- VAT - protected buildings.

IHBC NewsBlog

RICHeS Research Infrastructure offers ‘Full Access Fund Call’

RICHesS offers a ‘Help’ webinar on 11 March

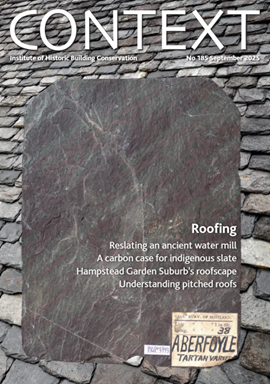

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?